First-time buyers in Frome face challenges, but mortgage costs remain lower than 1980s peak

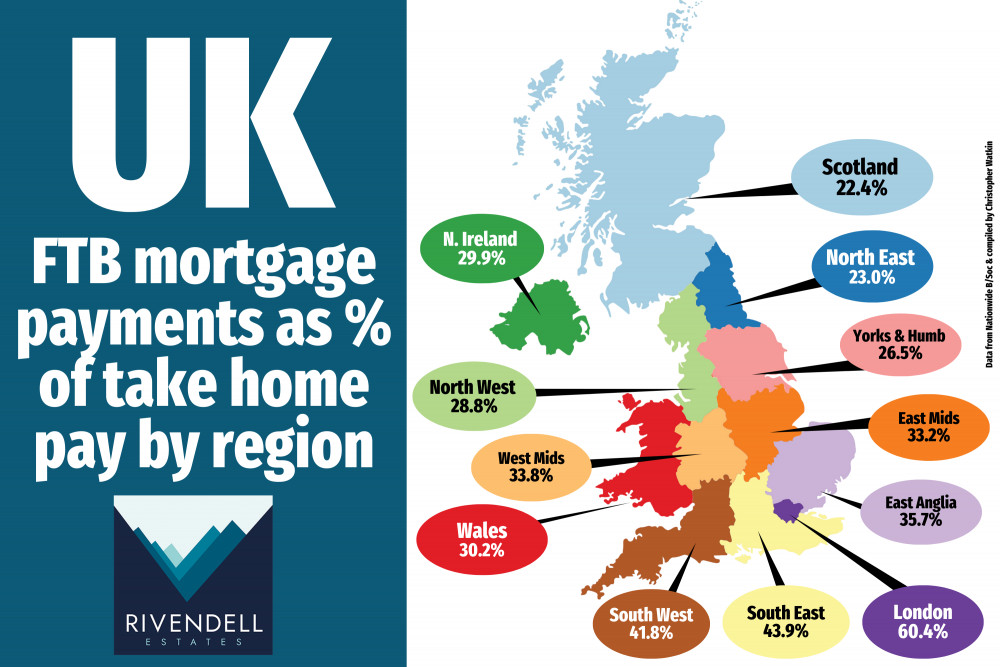

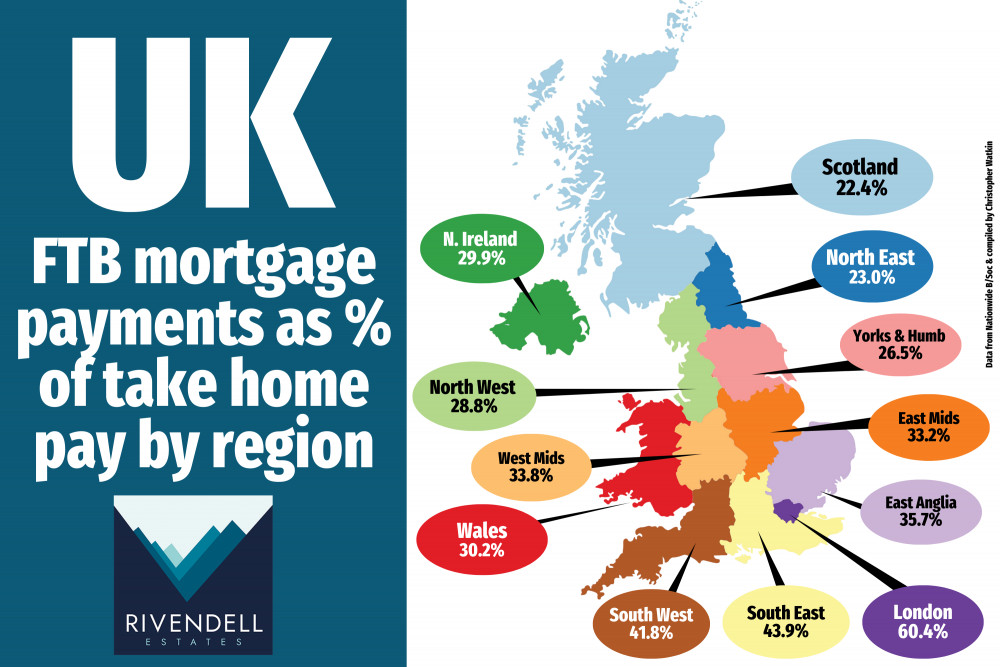

Nationwide data reveals mortgage payments as a share of take-home pay for first-time buyers, with Frome buyers weighing in.

By Laura Linham 19th Dec 2024

Recent data from Nationwide highlights the percentage of a first-time buyer's take-home pay required to cover mortgage payments across the UK. While these figures may seem high, it's important to note that they are, between 20% to 40% lower than in the late 1980s, when interest rates were significantly higher. This offers some perspective, especially given the challenges faced by first-time buyers in today's Frome property market.

Here is a breakdown of the data by region, starting with the highest:

- London: 60.4%

- South East: 43.9%

- South West: 41.8%

- East Anglia: 35.7%

- West Midlands: 33.8%

- East Midlands: 33.2%

- Wales: 30.2%

- Northern Ireland: 29.9%

- North West: 28.8%

- Yorkshire & Humber: 26.5%

- North East: 23.0%

- Scotland: 22.4%

While affordability challenges persist, today's first-time buyers are faring better than those in the late 1980s. However, these figures still highlight the financial commitment required to step onto the property ladder, especially in high demand regions like London and the South East.

Are you a first-time buyer in Frome? How are you finding things?

Share: