Business news and insolvencies continue to rise, but at lower rate than in 2022

By Guest author 18th Jan 2024

Corporate insolvencies in December continued to rise, with an increase of 2% compared to December 2023.

However, this increase was significantly lower than last December's year-on-year increase of 32%, according to figures published this week by the Insolvency Service.

This takes the number of corporate insolvencies in the month of December to 79% higher than pre-pandemic levels in 2019.

Personal insolvencies in December showed the largest year-on-year increase since the pandemic, decreasing by 20% compared to December 2022.

Tim Sloggett, South West Chair of R3, the UK's insolvency and restructuring trade body, comments on the publication of the December 2023 corporate and personal insolvency statistics for England and Wales:

"Whilst there appear to be some positive underlying trends with the rate of the increase in insolvencies declining, the figures published today reflect the continuing difficult economic conditions.

"Since the pandemic, the rise in insolvencies has been due to liquidations of small businesses, and the December numbers continue to reflect this trend.

Small businesses hit first

"These businesses are generally the first to be impacted by rising costs and large debts, as they often have lower profit margins and less levers to turn the business performance around.

"As trading conditions remain challenging and investment has deteriorated in recent years, we may start to see larger businesses impacted in 2024.

"We could see insolvency numbers continue to rise into the New Year, particularly in the retail and hospitality and leisure sectors, which are now heading into their low trading periods."

Tim, who is a managing director at business advisory firm Quantuma, continues: "When it comes to personal insolvencies, it is interesting that these have declined at the highest rate since the pandemic, despite raising personal debt levels and the squeeze on incomes.

"The year-on-year increase in the number of people entering a Breathing Space suggests that demands for debt support are still high, but that people aren't reaching the point where they need formal personal insolvency support.

"We are also seeing lenders being incredibly supportive to individuals that fall behind on payments to avoid bankruptcies than can often result in a worse outcome.

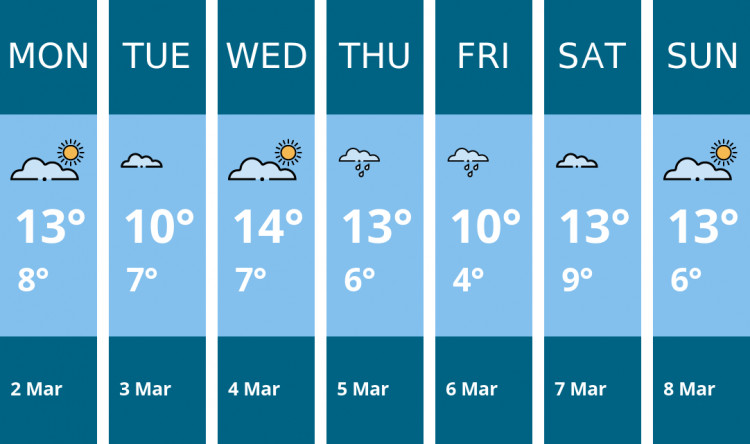

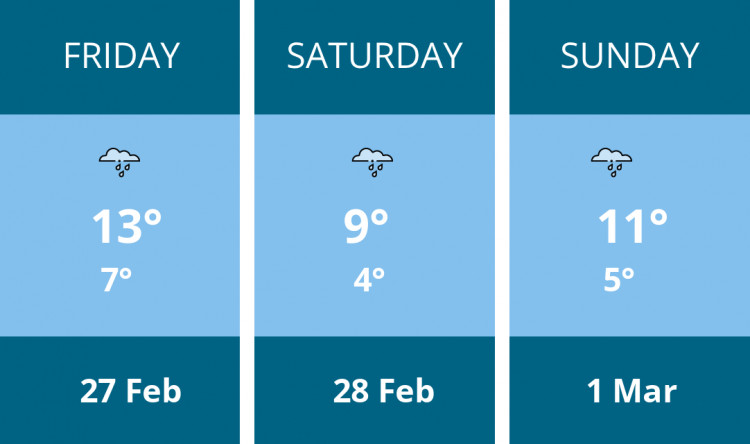

"As we head into the spring, it's likely that energy costs will continue to be a concern for many people with an increase in price caps from this month and government support coming to an end for many from next month.

"While food inflation and the price of petrol has been falling, events developing in the Middle East are likely to lead to renewed upward pressure on prices and could delay interest rate cuts.

"Combined, these factors could see insolvencies rise next month if these ongoing expenses become too much to manage.

Message to any businesses in the South West worried about finances

"Our message to anyone in the South West who is worried about money – whether that's yours or your business's – is simple: seek advice as soon as possible – the moment you start to become concerned.

We know it's a hard conversation to have, let alone start, but talking about your worries at an early stage will give you more time to take a decision about your next step and more potential options for moving forward.

"Most R3 members in the South West will offer a free consultation to prospective clients so they can understand more about their situation, and outline the potential solutions for resolving it."

CHECK OUT OUR Jobs Section HERE!

frome vacancies updated hourly!

Click here to see more: frome jobs

Share: